We’re recruiting!

We’re very excited to be recruiting a full or part time technical trainer and audit file reviewer to our team. Please get in touch if you know of anyone who might be interested. Click here for the job spec.

Upcoming courses

Our full schedule of public CPD courses can be browsed in our 2023 brochure and our booking form is available to download. Our 2024 programme is coming soon!

Date – Time – Course – Presenter

12th Oct – 9.30-12.30 – Top Tips for an Efficient Audit – Richard Hemmings

17th Oct – 9.30-12.30 – Tax Issues of Buying and Selling Businesses – Ros Martin

18th Oct – 9.30-12.30 – Practice Regulation Update – Edward Rands

3rd Nov – 9.30-12.30 – Auditing PIEs – Peter Herbert

7th Nov – 9.30-12.30 – MTD Update – Rebecca Benneyworth

9th Nov – 9.30-11.30 – Property Accounting Issues – Jez Williams

9th Nov – 12.30-1.30 – ISQM 1: Preparing for your first Annual Evaluation – Jez Williams

14th Nov – 9.30-12.30 – Financial Reporting + Tax Update – Peter Herbert & Ros Martin

21st Nov – 9.30-12.30 – Autumn Audit Update – Peter Herbert

21st Nov – 2.00-5.00 – Small and Micro Entity Accounts – Peter Herbert

23rd Nov – 9.30-12.30 – Corporation Tax Update – Ros Martin

Our 2023 AML E-Learning Programme is available to buy now.

“Excellent delivery, easily understood with some good points raised.” Delegate, Autumn series

FAQs from recent courses

Auditing

I’m looking to apply for audit responsible individual (RI) status with ICAEW. I’m concerned that I can’t demonstrate one or two of the competencies required by IES 8. What should I do?

If you have missed competencies, you will have to demonstrate, when commenting on CPD as part of your application, how you are going to address that competency requirement going forward. We understand that the ICAEW case manager looking at your case will also consider the importance of the missing competency in relation to your audit experience. We always encourage ICAEW members to think about the relevant competencies well in advance of applying for RI status and consider how relevant experience can be gained. This will help to prevent this problem arising.

Anti-Money Laundering

We assess risk for AML annually. How often should we reverify electronic info?

There are no hard and fast rules on how to perform ongoing due diligence. Many firms reassess risk annually for all clients and then carry out updated verification checks only if something significant comes to light. This could mean that an initial electronic check rarely gets revisited. Paragraph 5.2.8 of the CCAB AML guidance (AMLGAS) states that ongoing CDD may require the collection of less new information than was required at the very outset.

However, we increasingly find that firms perform periodic reviews every other year for normal risk clients and then formally reverify electronic information as part of this process.

Join Edward Rands for our Practice Regulation Update on 18th October.

Auditing

Where revenue is a significant risk, and we have comprehensive proof in total, are we still required to do tests of detail?

There are potentially two points to consider with this question. The first concerns the requirement in ISA 330 paragraph 21 that for a significant risk, where you are only performing substantive procedures, those procedures must include tests of detail. Where a proof in total is considered to be conclusive, some firms classify this as a test of detail referring to such a test as a ‘test in total’, to differentiate it from other high quality analytical procedures. However, this approach is only appropriate where the proof in total is performed with such a degree of precision that it genuinely provides the same level of assurance that an alternative test of detail would.

The second point concerns why revenue has been assessed as a significant risk area. Very often, because of the presumed risk of fraud in revenue recognition, firms tar the whole of the revenue section with the same significant risk brush. This is potentially missing a trick!

The presumed risk of fraud in revenue recognition is a very specific risk, namely that management could deliberately manipulate the recognition of revenue to achieve a certain accounting outcome. If the proof in total is addressing that risk then more detailed testing may be needed to deal with the presumption. But if the fraud risk applies to a specific assertion already being addressed by other procedures – or if the presumption can be rebutted – then the proof in total might stand alone.

From our recent Effective Analytical Review session with Richard Hemmings.

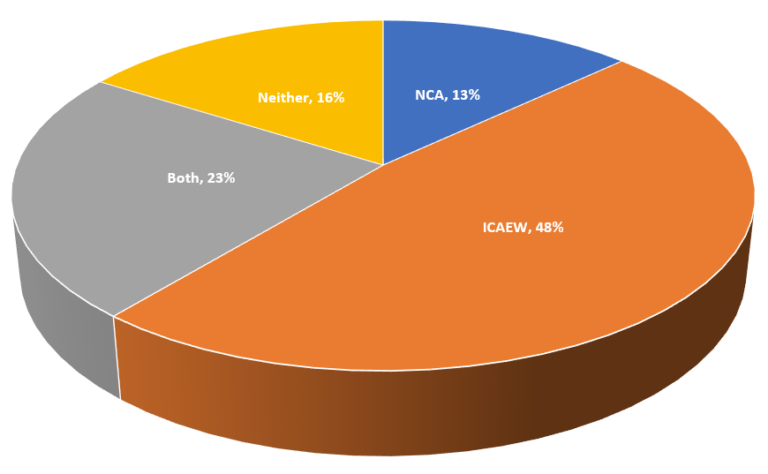

In a recent poll

A friend who works for another ICAEW firm is concerned that one or two of his colleagues in the tax department ‘turn a blind eye’ to clients paying staff in hand rather than through the payroll. Who would you report this to?

More participants suggested that this comment be officially reported than we would have anticipated! The key question is surely ‘why is your friend telling you this?!’ A report to the National Crime Agency under the AML SARs regime will not be necessary unless the remark was made in the course of business – unlikely if it’s a passing comment from a friend. A report to (e.g.) ICAEW under the Duty to Report Misconduct Regulations may be necessary but we still feel that this is likely a bigger issue for your friend than it is for you! More information on ICAEW’s Duty to Report Misconduct Regulations can be found here.