Upcoming courses

Our 2024 CPD programme is now live and open for bookings. Click to download our brochure and booking form.

Date – Time – Course – Presenter

27th Sept – 9.30-12.30 – Introduction to Audit part 1 – James Charlton

1st Oct – 9.30-12.30 – Practice Assurance Update – John Selwood

2nd Oct – 9.30-11.30 – IFRS Comprehensive Refresher – Clare Jones

2nd Oct – 11.45-12.45 – IFRS Update – Clare Jones

3rd Oct – 9.30-11.30 – How to Close Down an Audit – Richard Hemmings

8th Oct – 9.30-12.30 – Introduction to Audit part 2 – James Charlton

10th Oct – 9.30-12.30 – Autumn Tax Update – Rebecca Benneyworth

14th Oct – 9.30-12.30 – Autumn Financial Reporting Update – John Selwood

16th Oct – 9.30-11.30 – Ethics for Accountants and Auditors – Peter Herbert

Our new AML, Ethics and GDPR E-Learning Programmes are available now.

“Excellent delivery, easily understood with some good points raised.” Delegate, Autumn series

FAQs from recent courses

Practice Regulation

Where a company is a subsidiary, is its PSC the parent or the owners of the parent?

A PSC (person with significant control) is by definition an individual and not a legal entity. However, legal entities (e.g. parent companies) can own and control companies. A legal entity must be put on the PSC register if it is both relevant and registrable in relation to the company. What this effectively means is that where a subsidiary has a UK parent, that parent company will appear on the subsidiary’s PSC register. However where a subsidiary has a non-UK parent, there will be a need to ‘look through’ the non UK parent and list the individuals who control/influence it on the PSC register.

The detailed Companies House guidance can be accessed here.

Audit

What are your thoughts on spreading a sales sample across multiple revenue streams?

We would discourage this. For sampling to be effective, the population needs to be broadly homogenous. In the context of audit sampling, this means that all the items in the population have a similar risk of being misstated. This is generally by virtue of items being processed through the same sales system, rather than where they are included in the accounts. So, if different revenue streams are not homogenous in this way, they really must be tested separately.

Skills

What is the ‘Pomodoro Technique’?

It’s a time management method designed to improve productivity by breaking work into intervals, often 25 minutes in length, separated by short breaks. These intervals are called “Pomodoros,” the Italian word for tomatoes, named after the tomato-shaped kitchen timer that Cirillo (the inventor of the technique) used as a university student.

Here’s how it works:

- Choose a Task

- Set a Timer: (i.e. for 25 minutes, which is one Pomodoro).

- Work: Work on the task it until the timer rings.

- Take a Short Break: After the timer rings, take a short break (5 minutes is typical).

- Repeat: Repeat the process. After completing four Pomodoros, take a longer break (15-30 minutes).

Why it works?

Lots of reasons – key ones are that it breaks down tasks into chunks, meaning that it’s much more likely you can keep your concentration levels up for the pomodoro interval. Also, it enforces regular breaks which has been proven to improve your productivity.

And for those procrastinators out there – it helps you start the task you’ve been putting off! You can read more about it here.

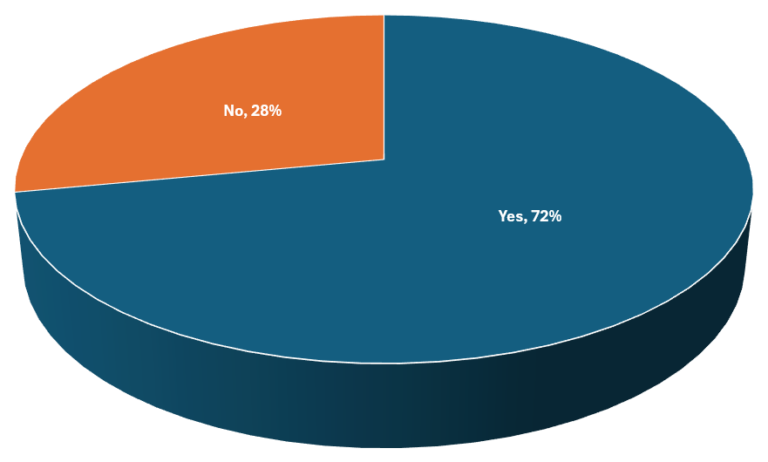

In a recent poll

Are you in favour of an increase in the charity audit threshold?

The government announcement in March about potential increases in micro, small and medium-sized companies could result in a 50% increase in the threshold for statutory audits. However, these changes do not extend to the charitable sector. Nonetheless, the Department for Culture, Media and Sport is committed to reviewing the thresholds and ICAEW is also strongly in favour of a review. The majority of respondents on this poll were in favour of an increase. A recent ICAEW Insight’s article can be accessed here. Watch this space!