2024 CPD Programme

Our 2024 CPD programme is now live and open for bookings. Click to download our brochure and booking form.

We’re recruiting!

We’re very excited to be recruiting a full or part time technical trainer and audit file reviewer to our team. Please get in touch if you know of anyone who might be interested. Click here for the job spec.

Upcoming courses

Our 2024 CPD programme is now live and open for bookings. Click to download our brochure and booking form.

Date – Time – Course – Presenter

7th Nov – 9.30-12.30 – MTD Update – Rebecca Benneyworth

9th Nov – 9.30-11.30 – Property Accounting Issues – Jez Williams

9th Nov – 12.30-1.30 – ISQM 1: Preparing for your first Annual Evaluation – Jez Williams

14th Nov – 9.30-12.30 – Financial Reporting + Tax Update – Peter Herbert & Ros Martin

21st Nov – 9.30-12.30 – Autumn Audit Update – Peter Herbert

21st Nov – 1.30-4.30 – Small and Micro Entity Accounts – Peter Herbert

23rd Nov – 9.30-12.30 – Corporation Tax Update – Ros Martin

28th Nov – 9.30-12.30 – What Makes a Good New RI – Peter Herbert

30th Nov – 9.30-12.30 – VAT Update – Dean Wootten

4th Dec – 9.30-12.30 – Property Taxes – Malcolm Greenbaum

6th Dec – 9.30-12.30 – Fraud, Laws and Regulations for the Auditor – Jez Williams

Our 2023 AML E-Learning Programme is available to buy now.

“Excellent delivery, easily understood with some good points raised.” Delegate, Autumn series

FAQs from recent courses

Auditing

Our latest audit programmes would suggest that directional testing is no longer ‘a thing’. Is that the case?

The principle of directional testing advocates putting more focus on overstatement of debits and understatement of credits. There are no hard and fast rules on applying it as it’s just a convention. We would therefore struggle to see why proprietary audit programmes would make it ‘a thing’. It’s still very relevant, though the principle doesn’t have to be applied. Sometimes auditors will conclude that there is a greater risk in respect of occurrence, rather than completeness of sales and they will focus their audit work in that area accordingly.

Interpersonal

How much of your working day do you spend being ‘purposeful’?

A question that came up on a recent workshop for audit seniors. We were discussing how best to manage energy levels and maximise concentration and focus – both hugely important elements in making efficient use of time. Research tells us that the average person only spends 10% of their day being truly purposeful, and up to 40% of the time they may be being distracted. And this research was undertaken more than twenty years ago – digital devices have become much more distracting over that time! So what can be done to manage distractions, particularly from digital devices? Overwhelmingly the group decided that phones on ‘do not disturb’ or ‘silent’ was a key first step for at least part of the day!

Practice Regulation

Is there anything we need to be aware of before agreeing to be an alternate for another practice in the event of death or incapacity?

In principle, you need to be aware of the likelihood of being required to take over the practice, and the amount of work which would be involved. That might involve a reasonably detailed ‘due diligence’ on the structure of the firm, its financial stability, and the nature and extent of its client base before you agree to act as alternate.

From our recent Practice Regulation Update with Edward Rands.

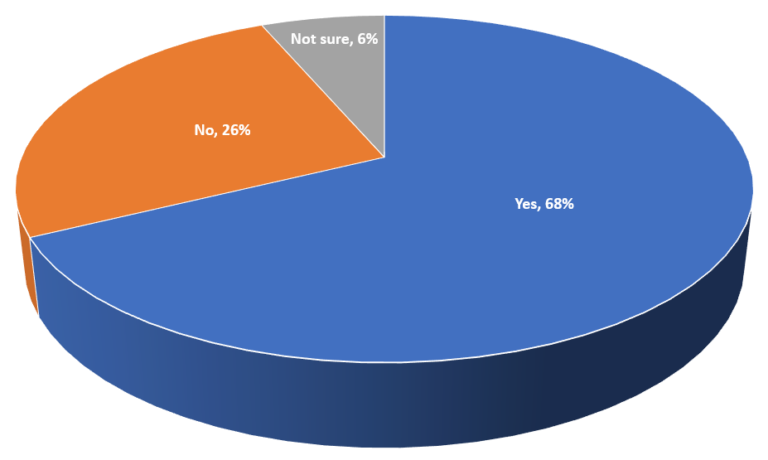

In a recent poll

Is the percentage of a balance covered by an audit test a relevant consideration in whether you have tested enough?

This answer is interesting. Clearly the greater the coverage, the greater the level of assurance. However reviewers don’t like to see unsubstantiated remarks like ‘we’ve got 80% coverage and that feels enough’. We would advise firms to either stratify the population, picking a random sample of items below performance materiality using a sample size calculation tool, or, alternatively, ensure that your coverage leaves the total amount of untested items at less than performance materiality.