We’re recruiting!

We’re very excited to be recruiting a full or part time technical trainer and audit file reviewer to our team. Please get in touch if you know of anyone who might be interested. Click here for the job spec.

Upcoming courses

Our 2024 CPD programme is now live and open for bookings. Click to download our brochure and booking form.

Date – Time – Course – Presenter

16th Apr – 9.30-12.30 – Incorporation, Disincorporation and Other Tax Planning – Ros Martin

17th Apr – 9.30-12.30 – Spring Financial Reporting Update – Peter Herbert

18th Apr – 9.30-11.30 – AML The Fundamentals – Peter Herbert

18th April – 12.30-1.30 – Auditing Revenue – Peter Herbert

25th April – 9.30-12.30 – Pension Tax Issues – Ros Martin

29th April – 9.30-12.30 – Spring Audit Update – John Selwood

2nd May – 9.30-11.30 – AML Update – Peter Herbert

2nd May – 11.45-12.45 – AML – Due Diligence Q&A – Peter Herbert

8th May – 9.30-12.30 – Budget Update – Malcolm Greenbaum

9th May – 9.30-12.30 – UK GAAP Accounts The Fundamentals – Jez Williams

Our new AML, Ethics and GDPR E-Learning Programmes are available now.

“Excellent delivery, easily understood with some good points raised.” Delegate, Autumn series

FAQs from recent courses

Audit

We act for a large charity (income £50M) which is a charitable incorporated organisation (CIO). The CIO has recently set up a limited company subsidiary. Will it need a separate audit?

Yes, it will. S479 CA06 provides specific audit exemption criteria for subsidiary undertakings that are companies. The default is that a non-dormant subsidiary in a medium-sized or large group needs an audit in its own right. It makes no difference that the parent company preparing the consolidated accounts is a CIO, rather than being a limited company itself.

The exemptions from audit afforded by Companies Act 2006 are: (1) a company is a standalone small company; (2) a company is a small member of a small worldwide group; (3) a company has a parent guarantee (highly unlikely in this situation); or (4) a company is dormant.

Financial Reporting

We act for a travel agent. They receive non-refundable deposits on holidays sold. When would these be recognised in the P&L?

The first issue here is whether the travel agent is acting as agent or principal. This will depend on whether it has exposure to risks and rewards related to the transaction. If it is the latter, then presumably the entity is simply acting as a conduit to get payments to the travel company, in which case the deposits will just sit in creditors until they are paid across.

If the travel agent is exposed to risks and rewards relating to the transactions, it is acting as principal. In this case, it will recognise income when transferring benefits to the customer. Thus, although the deposits are non-refundable, they will only be recognised in the P&L account at the point the holiday takes place – or when the customer cancels.

If the travel agent is acting as agent not principal, it will recognise its income in respect of the transaction (presumably its commission) when it has sold the holiday for the travel company. This could be when the booking is complete.

Practice Assurance – AML

We’re told that someone having a ‘high net worth (HNW)’ is a red flag when performing AML due diligence. What does this mean? Should we automatically treat such clients as high risk?

This is generally taken to mean all personal tax clients that have personal wealth greater than £20m and are considered ‘wealthy individuals’ by HMRC. A personal tax client having a high net worth can be a red flag but there is no expectation that a client would be considered high risk just because they were in this category. A key consideration will be what else is revealed by your initial and ongoing due diligence checks.

Notwithstanding this, we understand that this is currently a key area of focus for regulators. We understand that they are challenging firms hard to complete robust source funds/wealth checks on any HNWs that they act for.

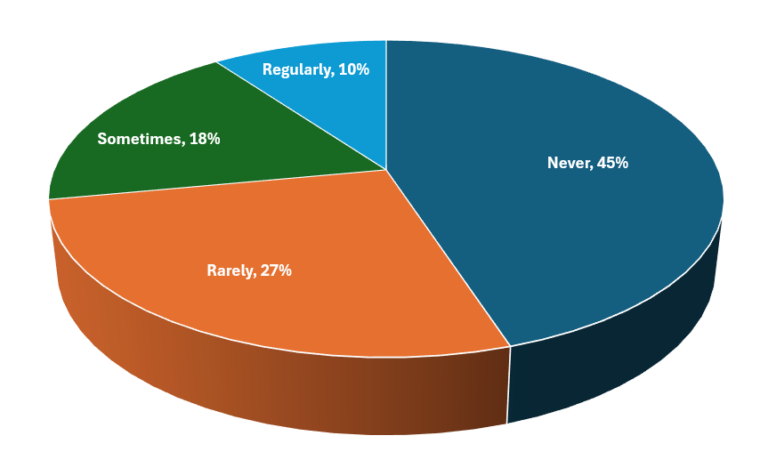

In a recent poll

When carrying out ISA audits, how often do you use tests of control?

Tests of control are not commonly used by independent audit firms. There is limited guidance within audit methodologies about how to use them; there is a general concern about the risk of management override; and sometimes they are simply less efficient than substantive tests.

However, in a world increasingly dominated by sample sizes which are not capped for substantive tests of detail, firms are seeking different approaches – and using tests of control is just one such approach.