We’re recruiting!

We’re very excited to be recruiting a full or part time technical trainer and audit file reviewer to our team. Please get in touch if you know of anyone who might be interested. Click here for the job spec.

Upcoming courses

Our full schedule of public CPD courses can be browsed in our 2023 brochure and our booking form is available to download.

Date – Time – Course – Presenter

27th Sept – 9.30 – 12.30 – Autumn Tax Update – Malcolm Greenbaum

3rd Oct – 9.30-11.30 – How to Audit a Charity – Richard Hemmings

3rd Oct – 12.30-1.30 – Analytical Review – Richard Hemmings

4th Oct – 9.30-11.00 – IFRS Update – Clare Jones

9th Oct – 9.30-12.30 – Autumn Financial Reporting Update – John Selwood

10th Oct – 9.30-11.30 – How to Become an Effective Audit Senior – Clare Jones

10th Oct – 12.30-1.30 – Auditing Stock – Clare Jones

12th Oct – 9.30-12.30 – Top Tips for an Efficient Audit – Richard Hemmings

17th Oct – 9.30-12.30 – Tax Issues of Buying and Selling Businesses – Ros Martin

18th Oct – 9.30-12.30 – Practice Regulation Update – Edward Rands

Our 2023 AML E-Learning Programme is available to buy now.

“Excellent delivery, easily understood with some good points raised.” Delegate, Autumn series

FAQs from recent courses

Financial Reporting

A parent lends its subsidiary a large sum on an interest-free basis. This is repayable when the subsidiary sells a certain investment property. Given that there is no date for when the asset will be sold, how do we apply the amortised cost method when accounting for the liability?

The first issue to consider here is whether there is a liability at all. If the subsidiary has no compulsion to ever sell the investment property, we would argue that the advance should be treated as a capital contribution (i.e. equity) in the books of the parent and the subsidiary.

Alternatively, if the parent could force the sale of the property at any time in order that the funds are returned to it by the subsidiary, then a liability would exist and it would be treated as falling due within one year in the books of the subsidiary. Legal form (as opposed to commercial substance) is a key driver when it comes to liability classification under FRS 102!

Financial Reporting – Academies

The first instalment of Universal Infant Free School Meals (UIFSM) funding is received in June 2023 for the academic year commencing in September 2023. Should this funding be recognised as deferred income or as restricted funds in the 2022-23 year-end financial statements?

This has been a topic which has created much debate on this summer’s Academy updates. If the money advanced is capable of being spent in the 2022-23 academic year, even though it represents 2023-24 funding, then it should be recognised as income in 2022-23 and unspent amounts classified as restricted funds at 31 August 2023. If it is not possible to spend the money in 2022-23 (i.e. there is a time restriction on its use) then amounts advanced should be treated as deferred income at 31 August 2023.

We believe that treating amounts advanced as restricted funds will often be the way to go. However trusts and auditors should check the terms of the advance carefully and ensure that SORP paragraph 5.10 is correctly applied.

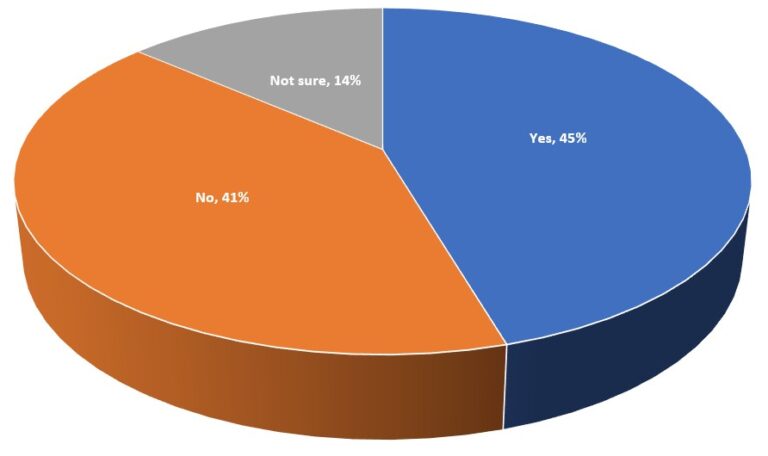

In a recent poll

Do you perform sanctions checks as standard when you take on a new client?

Given the risk profile of many smaller firms’ clients this seems like quite a high percentage. However, given that so many more firms use paid-for electronic checking services these days, it is understandable. These services usually check for sanctions as a matter of course. Professional bodies will expect firms’ policies and procedures to deal with the need for sanctions checks. A risk-based approach should be applied by firms on a case by case basis in determining whether such checks are actually needed.