Each month we’ll bring you a short CPD training video, our blog, technical updates and FAQs from courses and reviews.

We’re recruiting!

We’re very excited to be recruiting a full or part time technical trainer and audit file reviewer to our team. Please get in touch if you know of anyone who might be interested. Click here for the job spec.

New website

While you’re here, why not browse our new website?

Upcoming courses

Our full schedule of public CPD courses can be browsed in our 2023 brochure and our booking form is available to download.

Date – Time – Course – Presenter

2nd Mar – 9.30-12.30 – Introduction to Charity Accounts and Audit – Richard Hemmings

3rd Mar – 9.30-12.30 – VAT on Land and Property – Dean Wootten

6th Mar – 9.30-12.30 – Ethics for Accountants and Auditors – Peter Herbert

7th Mar – 9.30-12.30 – Hot Topics in Charities – Peter Herbert

10th Mar – 9.30-12.30 – Spring Tax Update – Malcolm Greenbaum

15th Mar – 9.30-11.30 – Independent Examination of Charities – Richard Hemmings

16th Mar – 9.30-12.30 – Practical PAYE and NIC Update – Alexandra Durrant

28th Mar – 9.30-12.30 – ISA 315 + 240 – Practical Implication Challenges – Peter Herbert

Our 2023 AML E-Learning Programme will be released by 1st Feb 2023.

“Excellent delivery, easily understood with some good points raised.” Delegate, Autumn series

FAQs from recent courses

Financial Reporting – LLPs

We’ve recent started to act for an LLP. In its financial statements, revaluation gains on property, plant and equipment are included in profit for the year and credited to members’ loan accounts rather than to a revaluation reserve. Can this be right?

It can! Oddly there are no ‘distributable profits’ rules in LLPs, so the need to credit gains and losses to members’ loan accounts is always based on what the members’ agreement says. So whilst we would normally expect an LLP to credit such a gain to a revaluation reserve in equity it may not always happen. The firm that raised this query shared the members’ agreement with us. It was poorly drafted – and as clear as mud!

Practice Regulation

There’s a lot in the accounting press about the ‘Register of Overseas Entities’. What is this and does it affect our firm?

It was brought in as part of the Economic Crime Act 2022. Overseas entities that have an interest in property or land (freehold or leasehold with a lease exceeding 7 years) must register their beneficial owners and managing officers with Companies House. Entities have 6 months from 1 August 2022 to register so the deadline is the end of January 2023. Failure to comply will attract fines.

From 1 April 2023, firms will need to (as part of their due diligence procedures) check relevant entries on the register at the point of take-on and on an ongoing basis.

Financial Reporting

A colleague recently mentioned International Sustainability Standards – what’s this about?

On a recent course, 82% of delegates hadn’t heard of this. For large organisations, narrative reports have, in recent years, included details of energy consumption and related green house gas emissions, based on the UK Streamlined Energy and Carbon Reporting Regulations. Many feel that a more ‘joined up global approach to disclosures is needed and these standards will provide it. It will be interesting to see which companies the FRC requires to apply the standards and from when. Watch this space!

Financial Reporting

The Corporate Transparency and Register Reform White Paper was much discussed on courses last year. What’s the latest?

Relevant legislation is getting close. There is now a second Economic Crime Bill which, as we approach the end of January 2023, is at the Report Stage in parliament. We will cover it in more detail on courses in 2023. A key change (as expected) will be a need for small and micro sized companies to file a P&L account at Companies House.

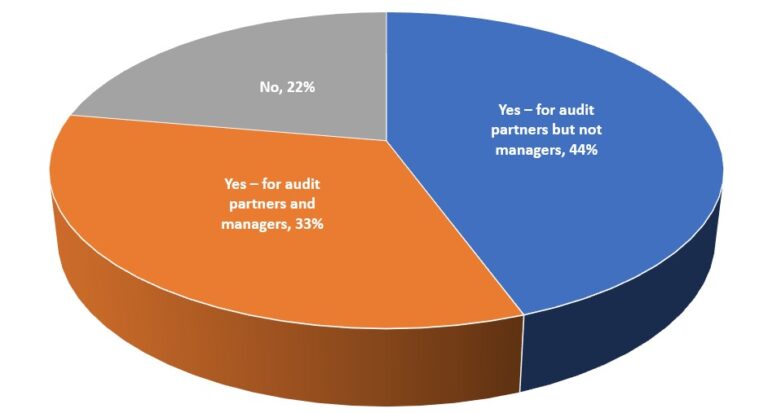

In a recent poll - CPD

Is IES 8 considered annually when considering CPD requirements within your firm?

IES 8 sets out the professional competences that auditors need to develop and maintain. The competences provide an excellent summary of what it takes to perform at a senior level, and considering them when planning CPD is a fantastic opportunity to embed these skills at an early stage. If nothing else, it means that those managers applying to become an RI may find it easier to find relevant examples to put on their application.

So it’s great that 33% of respondents were able to report that IES8 is considered for partners and mangers – but for the 66% that only considered it for partners, or not at all – perhaps it’s an opportunity missed. After all, the professional skills cover a wide range of interpersonal competences, such as communication, that benefit the whole firm, not just those involved in audit.