Each month we’ll bring you a short CPD training video, our blog, technical updates and FAQs from courses and reviews.

We’re recruiting!

We’re very excited to be recruiting a full or part time technical trainer and audit file reviewer to our team. Please get in touch if you know of anyone who might be interested. Click here for the job spec.

New website

While you’re here, why not browse our new website?

Upcoming courses

Our full schedule of public CPD courses can be browsed in our 2023 brochure and our booking form is available to download.

Date – Time – Course – Presenter

2nd Mar – 9.30-12.30 – Introduction to Charity Accounts and Audit – Richard Hemmings

3rd Mar – 9.30-12.30 – VAT on Land and Property – Dean Wootten

6th Mar – 9.30-12.30 – Ethics for Accountants and Auditors – Peter Herbert

7th Mar – 9.30-12.30 – Hot Topics in Charities – Peter Herbert

10th Mar – 9.30-12.30 – Spring Tax Update – Malcolm Greenbaum

15th Mar – 9.30-11.30 – Independent Examination of Charities – Richard Hemmings

16th Mar – 9.30-12.30 – Practical PAYE and NIC Update – Alexandra Durrant

28th Mar – 9.30-12.30 – ISA 315 + 240 – Practical Implication Challenges – Peter Herbert

Our 2023 AML E-Learning Programme will be released by 1st Feb 2023.

“Excellent delivery, easily understood with some good points raised.” Delegate, Autumn series

FAQs from recent courses

Financial Reporting – Groups

We act for a wholly owned subsidiary of a Japanese parent company which trades in the UK. This company is below the UK audit threshold. We are unsure of the figures for the Japanese parent company but we can assume they will be high enough to push the group above the small group limits. Does our client require an audit?

Yes it does. Under section 475 of Companies Act 2006, there are four ways to obtain audit exemption: (1) by being a small standalone company; (2) by being a small member of a small group worldwide; (3) any sized company in a UK group with a parental guarantee; or (4) dormancy. None of these applies here so the UK subsidiary will need an audit.

Interpersonal

How much guidance is considered molly-coddling? Where is the line between being clear in your objectives and providing too much guidance that it becomes molly-coddling?

This came from a webinar we presented recently for the ICAEW Audit Faculty on ‘What makes a Good Audit Manager’.

We had talked about the importance of letting more junior staff take responsibility for their work, to give them a clear briefing and then let them ‘have a go’. The important thing is communicating what needs to be achieved and the junior should be encouraged to take responsibility for the how. How much guidance is required will depend on the individual and their experience – a useful tip here is ‘back briefing’. After your briefing, they brief back to you explaining their understanding of the objective and how they plan to carry out the work. This gives you an opportunity to see how much they know and how much guidance you need to give.

VAT

What are the VAT issues when a residential developer buys a pub with owners accommodation on the first floor with a view to converting the property into four flats?

Where the seller has opted to tax the property the developer should consider issuing Form 1614D to disapply the sellers option to tax. Issuing Form 1614D on a timely basis removes VAT from the purchase price and as a consequence will reduce the SDLT payable on purchase. The developer will then need a good understanding of the 5% and 20% VAT rates on the conversion project as both will be in point depending on the nature of the services and materials acquired. The developer will also need to consider the domestic reverse charge and whether they should issue their contractors with end user confirmations. When selling the four flats the developer needs to understand the impact of selling the ground floor flats zero rated and the first floor flats exempt.

For further details on all the quirks of VAT on Land and Property transactions, join Dean Wootten on 3rd March.

In a recent poll

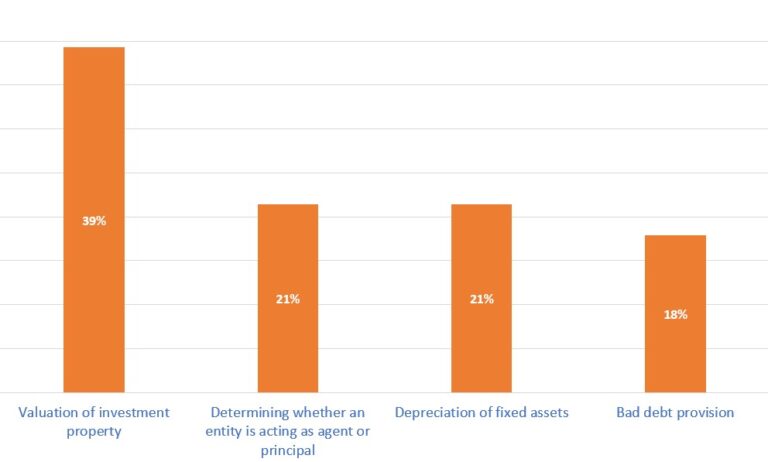

Which of the following is an accounting judgement?

We often distinguish between judgements and sources of estimation uncertainty as follows: a judgement involves making a close call on an accounting treatment; a source of estimation uncertainty is where the accounting treatment is clear cut but determining the number is hard. Of the choices given, valuation of investment property, depreciation of fixed assets and determining bad debt provisions all involve estimation uncertainty. The judgement here is working out whether the seller is acting as agent or principal. The minority of 21% have it!