We’re recruiting!

We’re very excited to be recruiting a full or part time technical trainer and audit file reviewer to our team. Please get in touch if you know of anyone who might be interested. Click here for the job spec.

In our last newsletter of 2023, we’d like to take this opportunity to thank all of our clients and colleagues for your support and custom this year – we’ve thoroughly enjoyed working with you. From all the team at Insight Training we would like to wish you a happy and healthy festive season and all the very best for 2024.

2024 Programme now live

Our 2024 CPD programme is now live and open for bookings. Click to download our brochure and booking form.

Upcoming courses

Our 2024 CPD programme is now live and open for bookings. Click to download our brochure and booking form.

Date – Time – Course – Presenter

4th Mar – 9.30-12.30 – Charity Accounts and Audit – The Fundamentals – James Charlton

5th Mar – 9.30-12.30 – Pension Accounts and Audit – The Fundamentals – Peter Herbert

11th Mar – 9.30-12.30 – Planning an ISA Compliant Audit – Richard Hemmings

12th Mar – 9.30-12.30 – Practical PAYE and NIC Update – Alexandra Durrant

13th Mar – 9.30-11.30 – Independent Examination of Charities – Peter Herbert

13th Mar – 12.30-1.30 – Analytical Review – Peter Herbert

20th Mar – 9.30-12.30 – Charities Update – Richard Hemmings

21st Mar – 9.30-12.30 – Spring Tax Update – Rebecca Benneyworth

Watch out for our new AML, Ethics and GDPR E-Learning Programmes – available from February 2024.

“Excellent delivery, easily understood with some good points raised.” Delegate, Autumn series

FAQs from recent courses

Auditing

Is ISQM 2 applicable to firms who don’t audit listed entities or PIEs?

It’s actually paragraph 34 of ISQM 1 which determines when engagement quality reviews (the topic of ISQM 2) are required and they are broadly limited to listed entity audits and public interest entity (PIE) audits, not to be mistaken with public benefit entity audits.

However, the approach to engagement quality reviews can be helpfully rolled out to second partner reviews and other consultation reviews performed by firms not operating in the PIE or listed company space. Accordingly, ISQM 2 can be relevant and helpful to far more firms than you would think.

Financial Reporting

Our client is a landlord. Its fire alarm systems are no longer compliant. They spend £150k to replace and update. Would this be capitalised?

Quite possibly. If the transaction involved the replacement of an existing fire alarm system, the NBV of the replaced system would likely be written out of the books and the cost of the new one capitalised. If it were simply a question of updating an existing system, the cost would only be capitalised if it gave rise to incremental economic benefit. This would be the case if the expenditure allowed the system to operate longer than originally intended or to operate more efficiently.

Auditing

What happens if a subsidiary company is medium in its own right but the group on a consolidated net basis is small and thus doesn’t need group accounts. Does it still need an audit?

Yes, it does. The interrelationship of gross thresholds (before consolidation eliminations) and net thresholds (after consolidation eliminations) mean that the concept of a medium sized subsidiary in a small group is more common than you might think. Any standalone UK company which is medium-sized in its own right needs an audit, even if the group within which it sits is small.

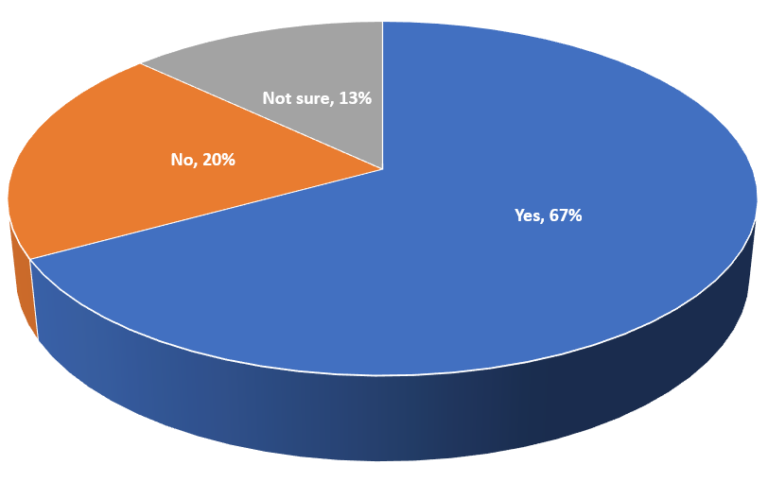

In a recent poll

Are you in favour of an increase in the audit thresholds?

This poll has cropped up on financial reporting and audit update courses during which we’ve been discussing recent Department for Business and Trade consultations about potentially increasing limits, especially in view of the current inflationary environment. Although it might mean firms doing less audits, many seem to be in favour of an increase in the thresholds!