Upcoming courses

Our full 2025 CPD programme is on our website.

You can download our booking form and brochure here.

Date – Time – Course – Presenter

2nd Oct – 1.00-2.00 – Maintaining Focus and Motivation – Nicky Clough

7th Oct – 1.30-4.30 – Autumn Tax Update – Rebecca Benneyworth

8th Oct – 9.30-12.30 – Fraud, Journals and Data Analytics – Jez Williams

9th Oct – 9.30-11.30 – IFRS Comprehensive Refresher – Clare Jones

9th Oct – 11.45-12.45 – IFRS Update – Clare Jones

13th Oct – 9.30-12.30 – Autumn Financial Reporting Update – John Selwood

14th Oct – 9.30-12.30 – Audit – All the Bits you used to Know – Maya Norbury

21st Oct – 9.30-11.30 – How to Audit a Charity – Richard Hemmings

21st Oct – 12.30-1.30 – Auditing Accounting Estimates – Richard Hemmings

22nd Oct – 9.30-11.30 – FRS 102 Periodic Review – Revenue – Peter Herbert

22nd Oct – 12.30-2.00 – Ethics for Accountants and Auditors – Peter Herbert

24th Oct – 9.30-12.30 – Family Tax Planning – Malcolm Greenbaum

Our 2025 AML, Ethics and GDPR E-Learning Programmes are available now.

“Excellent delivery, easily understood with some good points raised.” Delegate, Autumn series

FAQs from recent courses

Financial Reporting

When do the filing requirements for small and micro entity accounts change. Will the changes come in at the same time that the FRS 102 periodic review changes do?

Companies House announced during the summer that the new filing rules will take effect from 1 April 2027 and we’ve taken this to mean all financial statements filed on or after that date. From that date all financial statements will also have to be filed using commercial software. An article in the Financial Times just after the Companies House announcement suggested that the government might actually do a U-turn on this, but nothing’s been announced – so watch this space!

Audit

Where a company has multiple income streams should a single audit sample be spread across these income streams?

Although many auditors do this, we would discourage this approach because a population to which a sampling procedure is applied must be homogenous and this is unlikely to be the case for different income streams. Different income streams will be subject to different risk profiles and assertion risks and each sample should be driven by that. Nonetheless, if you happen to have income streams that have the same risk profile, doing separate samples would probably give you much the same sample size as if you’d worked it out as one population.

Financial Reporting

A company has an industrial park which has been under construction for some years. This has been accounted for at cost. Is this correct?

It’s possible that the asset described here is an investment property, rather than property, plant and equipment (PPE). Investment property is defined as ‘property (land or a building, or part of a building or both) held by the owner(…), to earn rentals (…) rather than for; a) use in the production or supply of goods or services or for administrative purposes; or b) sale in the ordinary course of business. FRS 102 requires investment property to be accounted for at fair value rather than cost and this applies to investment property in the course of construction, as well as completed investment property.

However, our experience of this is that it is often hard to determine the fair value of investment property in the course of construction. Therefore some entities account for it at cost until it is substantially complete, at which point it will be possible to determine – and use – a fair value.

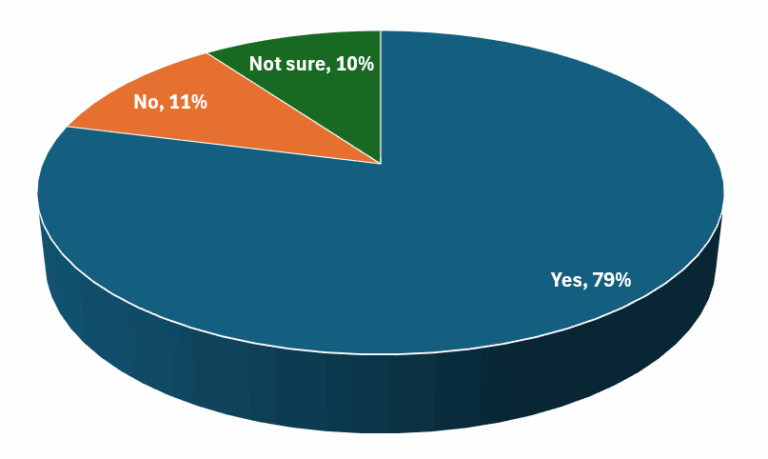

In a recent poll

Do you think a separate auditing standard for less complex entity audits is a good idea?

We ran this poll when discussing the FRC’s recent Exposure Draft of a Practice Note for Smaller and Less Complex Entities. Such a Practice Note is not a standard as such and, although the International Audit and Assurance Standard Board (IAASB) have developed such a standard (ISA for Less Complex Entities), it’s not something the Financial Reporting Council (FRC) supports in the UK.