In this month’s vlog, Peter Herbert goes back to basics on materiality and performance materiality.

In May’s blog, we discuss the new ‘five step model’ for recognising income under the periodic review changes.

Upcoming courses

Our full 2025 CPD programme is on our website.

You can download our booking form and brochure here.

Date – Time – Course – Presenter

20th May – 1.00-2.00 – Effective Delegation and Coaching your Team – Nicky Clough

21st May – 9.30-12.30 – Accounting for Groups – James Charlton

3rd June – 9.30-12.30 – Company and Director Tax Issues – Rebecca Benneyworth

10th June – 9.30-12.30 – VAT – The Fundamentals – Dean Wootten

11th June – 9.30-12.30 – How to Become an Effective Audit Senior – Maya Norbury

12th June – 1.00-2.00 – Leading with Confidence – Nicky Clough

17th June – 9.30-12.30 – Practice Assurance Refresher and Update – Peter Herbert

18th June – 9.30-12.30 – Auditing Groups (including ISA 600 revised) – James Charlton

20th June – 9.30-12.30 – Tax for Auditors – Malcolm Greenbaum

Our 2025 AML, Ethics and GDPR E-Learning Programmes are available now.

“Excellent delivery, easily understood with some good points raised.” Delegate, Autumn series

FAQs from recent courses

Not for profit

We have just started to act for a Cooperative and Community Benefit Society (CCBS). Is it true that all CCBSs need an audit?

The audit requirements for CCBSs are dealt with by sections 83-84 of the CCBS Act 2014. This requires all CCBSs to be audited, though a small CCBS ‘can appoint two or more persons who are not qualified auditors to audit its accounts and balance sheet for that year.’ A small CCBS is typically one which had receipts and payments in the previous year which did not exceed £5K. However, the CCBS can disapply the audit requirement in a general meeting where its income does not exceed £10.2M and its total assets do not exceed £5.1M.

Section 84 of the Act also precludes audit exemption in specific circumstances, including where a CCBS is a subsidiary, has a subsidiary or is registered in Scotland.

MTD

If quarterly MTD’s are on cash basis, does that prevent using accruals for final figures?

No, as far as we understand at the moment, it is being assumed that the quarterly MTD returns will be cash basis. The decision to use accruals for the final figures can be made at the time that the end of year statement is submitted, when any adjustments needed will have to be made (such as capital allowances if applicable).

Financial Reporting

We have a small group which prepares consolidated accounts. If you have voluntarily prepared consolidated accounts, can you then revert to not consolidating if there is no legal requirement?

It is possible to revert to non-consolidation having previously consolidated. This could be relevant from p/c 6 April 2025 when small company and group size limits increase. However, it’s important to remember that this is a change in policy and will need to be fully disclosed. It will be important to emphasise as part of this disclosure that the comparative figures are ‘parent only.’

Practice Assurance

We understand that we can help clients with identity verification (IDV), soon to be required under the Economic Crime and Corporate Transparency Act (ECCTA). However, we’ve heard that this will require specialist training. Is that true?

This is potentially true. Where an Authorised Corporate Service Provider (ACSP) performs IDV for a client, there two ways to approach it. One approach (option one) requires the ACSP to be able to check the cryptographic features of an identity document (i.e. that it is a bona fide document). This will require relevant technology, though specialist third party organisations are likely to help.

Option two involves the ACSP performing a manual check. Companies House guidance makes clear that, if a person (rather than technology) is being used to check a document, they must be trained in detecting false documents by a specialist training provider (e.g. the Home Office or National Document Fraud Unit). It will be interesting to see how this is policed. We suspect that it will be by professional bodies like ICAEW/ACCA during inspection visits.

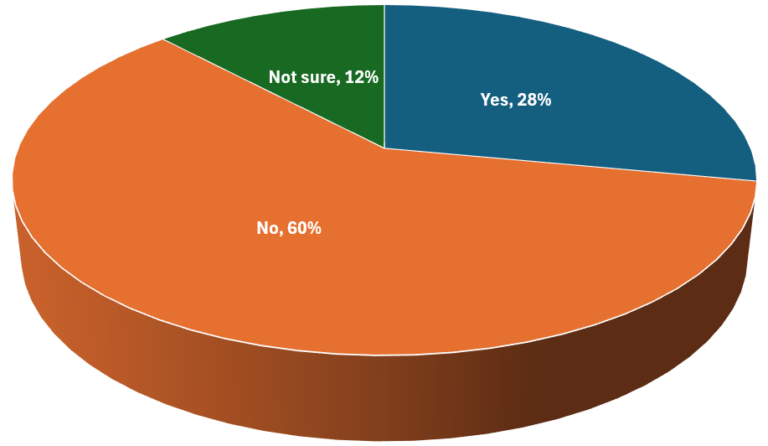

In a recent poll

Are you in favour of the more onerous disclosure rules brough in by the FRS 102 periodic review for small entities?

The FRS 102 periodic review ramps up disclosure requirements for small companies applying section 1A from accounting periods beginning on or after 1 January 2026. Whilst this will ensure more transparency, course participants here were more concerned about the loss of privacy. One key area of change concerns the disclosure of related party transactions.