We’re recruiting!

We’re very excited to be recruiting a full or part time technical trainer and audit file reviewer to our team. Please get in touch if you know of anyone who might be interested. Click here for the job spec.

Upcoming courses

Our 2024 CPD programme is now live and open for bookings. Click to download our brochure and booking form.

Date – Time – Course – Presenter

11th Mar – 9.30-12.30 – Planning an ISA Compliant Audit – Richard Hemmings

12th Mar – 9.30-12.30 – Practical PAYE and NIC Update – Alexandra Durrant

13th Mar – 9.30-11.30 – Independent Examination of Charities – Peter Herbert

13th Mar – 12.30-1.30 – Analytical Review – Peter Herbert

20th Mar – 9.30-12.30 – Charities Update – Richard Hemmings

21st Mar – 9.30-12.30 – Spring Tax Update – Rebecca Benneyworth

16th Apr – 9.30-12.30 – Incorporation, Disincorporation and Other Tax Planning – Ros Martin

17th Apr – 9.30-12.30 – Spring Financial Reporting Update – Peter Herbert

18th Apr – 9.30-11.30 – AML The Fundamentals – Peter Herbert

Our new AML, Ethics and GDPR E-Learning Programmes are available now.

“Excellent delivery, easily understood with some good points raised.” Delegate, Autumn series

FAQs from recent courses

Audit

Although our firm retains its audit registration, it only does Solicitors Regulation Authority (SRA) assignments these days as a matter of choice. Is ISQM 1 relevant?

The scope of ISQM (UK) 1 is laid out in paragraph 5 of the standard. As we see it, a firm just carrying out SRA work would not need to comply. However, we have had feedback from a few firms recently that ICAEW sees things differently and takes the view that if RI status is to be retained, ISQM 1 compliance is mandatory. This might not be impossibly hard though. A proportionate approach is required so a basic risk assessment and simple set of procedures will surely suffice.

Not for Profit

We act for a Cooperative Community Benefit Society which has recently set up a subsidiary. Will the subsidiary need an audit?

This question has cropped up twice recently. CCBSs are regulated by the Financial Conduct Authority (FCA). CCBS groups must prepare consolidated financial statements. Exemption from consolidation itself must be approved by the FCA and can only be sought where consolidation is impracticable or would be of no real value to the society’s members.

In addition, the FCA mandates that if a CCBS has a subsidiary or is a subsidiary itself then a separate audit is required. Here’s a link to the FCA website https://www.fca.org.uk/firms/managing-your-society/having-or-becoming-subsidiary

S479A of the Companies Act allows an exemption from audit where a parental guarantee is provided but no such mechanism exists in the CCBS 2014 Act.

Financial Reporting

We’ve heard that implementation of the Economic Crime and Corporate Transparency Act has begun. Is this true – and from when?

This is true. The first substantial series of provisions take effect from 4 March 2024. Of the changes coming in, those of particular interest to accountants are (1) greater powers for Companies House to query information/request supporting evidence; and (2) a requirement for all companies to provide a registered email address and registered office addresses when submitting their annual confirmation statement. It is still not clear when the changes affecting accounts filing and identification checks for directors and PSCs will take effect. Watch this space!

In a recent poll

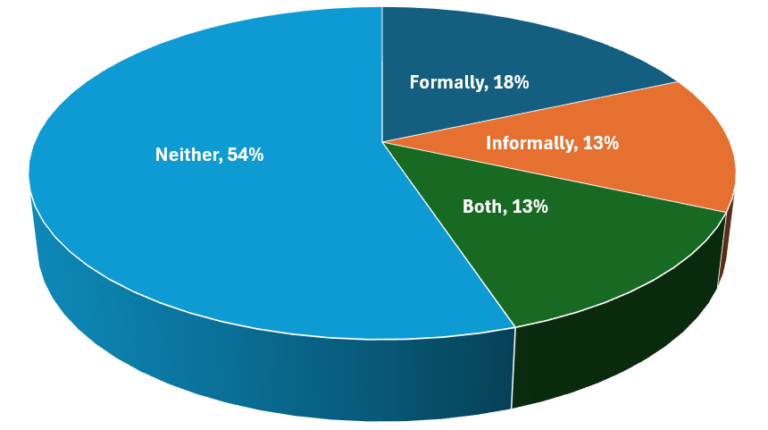

Have you ever reported a money laundering suspicion internally?

Given that there is no de minimis threshold, and never has been, we would perhaps expect this figure to be higher. However, the reality is that accountants tend to make relatively few reports to the National Crime Agency. Although informal reporting to the Money Laundering Reporting Officer (MLRO) is fine, it’s well worth knowing where to access you firm’s internal reporting form. A formal internal report means that no one can subsequently question whether you’ve properly fulfilled your obligations under the legislation.