Upcoming courses

Our full schedule of public CPD courses can be browsed on our website here.

Date – Time – Course – Presenter

20th June – 9.30-12.30 – Tax for Auditors – Malcolm Greenbaum

24th June – 9.30-11.00 – Going Concern – Maya Norbury

24th June – 11.30-1.00 – Auditing Creditors – Maya Norbury

25th June – 9.30-12.30 – Accounting for & Auditing Construction Contracts – James Charlton

26th June – How to Become an Effective Audit Manager – Nicky Clough and Maya Norbury

2nd July – 9.30-12.30 – Academies & FE Colleges Refresher & Update – James Charlton

9th July – 9.30-12.30 – Academy Accounts and Audit Fundamentals – James Charlton

2nd Oct – 1.00-2.00 – Maintaining Focus and Motivation – Nicky Clough

Our 2025 AML, Ethics and GDPR E-Learning Programmes are available now.

“Excellent delivery, easily understood with some good points raised.” Delegate, Autumn series

FAQs from recent courses

Audit

Does the update to ISA (UK) 600 mean that branches of an individual company need to be considered for the risk assessment in a stand alone entity audit?

The revised ISA makes clear (paragraph A4) that, when a business operates through branches which have characteristics such as separate locations, separate management or separate information systems, and the financial information is aggregated in preparing a single legal entity’s financial statements, such financial statements meet the definition of group financial statements – and therefore ISA 600 is relevant.

However, the branches would not necessarily need to be considered as separate components. There is much flexibility about how individual components are defined. It could be by entity, by business unit, by finance unit, by function or by location. Determining how to define components is probably the first task to undertake when planning and performing an audit under the revised ISA.

Financial Reporting

We act for a single shareholder director company which holds an investment portfolio. Is this company precluded from applying FRS 105 because it meets the definition of an investment undertaking?

An investment undertaking is defined as an entity whose sole purpose is to invest funds in various assets like securities and real estate, aiming to spread investment risks and provide returns to its shareholders through asset management. Investment undertakings can’t apply FRS 105.

A company holding a share portfolio as its only activity could meet this definition. However, a company holding only one or a few investments may not be ‘spreading risk’ or giving shareholders ‘the benefit of the result of management of the assets’. In practice, the definition seems to be intended to catch the sort of investment fund where there are investors who are not closely involved in the management, As micro-companies are rarely audited, it will be for the directors to form a judgement about whether they fall within the definition and are therefore ineligible.

Charities

If one of the trustees of a charity is supplying some goods/services to a trading subsidiary, is that disclosable in the charity accounts?

We feel that disclosure here would be necessary in the group accounts. Trustees are always considered to be related parties of charitable groups and any transaction a trustee enters into with any group component should be disclosed.

Professional Skills

What’s the difference between Leadership and Management?

A question that often comes up on our skills programmes and a topic we’ll explore in the next of our bitesize skills sessions.

Both are about the effective and efficient pursuit of a goal. Management is the process of planning, organising, directing and controlling resources. Leadership is about influencing and inspiring the thinking, attitudes and behaviour of people.

Resources may be money, time and, of course, may include people. All resources including people should be well managed and effectively directed. This requires process. But too much focus on process and we lose sight of the personal element. Being a leader can mean letting go of direct control to focus on the individual, seeking to inspire and influence them towards a clear purpose. Effective leaders bring out the best in people, motivating them to work towards a goal, often independently.

Leadership and management are both essential to success. It’s essential to get the balance right between ‘process and purpose’. Both are about achieving a goal. Management is about the process. Leadership about people and purpose.

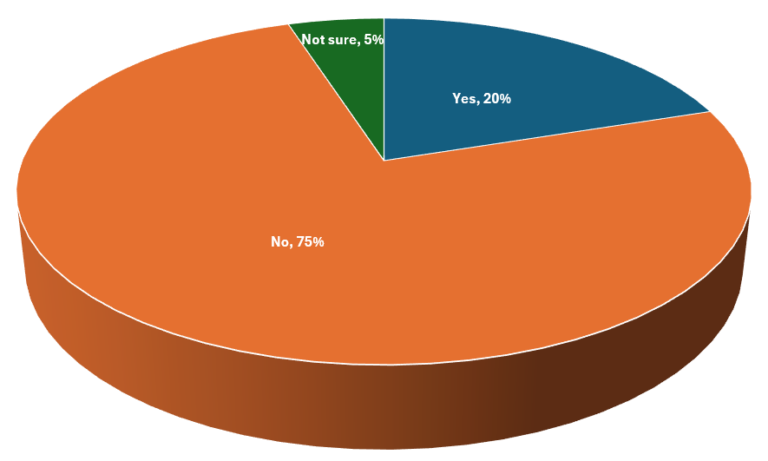

In a recent poll

Does your firm prepare dividend waivers for clients?

Firms need to be very careful about engaging in this sort of activity as it is generally considered to be a ‘reserved legal activity’ and is therefore off bounds. ICAEW has a useful guide on accountants and legal services which can be downloaded here . We were surprised how many respondents to this poll stated that they did get involved in this sort of activity.