We’re recruiting!

We’re very excited to be recruiting a full or part time technical trainer and audit file reviewer to our team. Please get in touch if you know of anyone who might be interested. Click here for the job spec.

Upcoming courses

Our 2024 CPD programme is now live and open for bookings. Click to download our brochure and booking form.

Date – Time – Course – Presenter

4th Mar – 9.30-12.30 – Charity Accounts and Audit – The Fundamentals – James Charlton

5th Mar – 9.30-12.30 – Pension Accounts and Audit – The Fundamentals – Peter Herbert

11th Mar – 9.30-12.30 – Planning an ISA Compliant Audit – Richard Hemmings

12th Mar – 9.30-12.30 – Practical PAYE and NIC Update – Alexandra Durrant

13th Mar – 9.30-11.30 – Independent Examination of Charities – Peter Herbert

13th Mar – 12.30-1.30 – Analytical Review – Peter Herbert

20th Mar – 9.30-12.30 – Charities Update – Richard Hemmings

21st Mar – 9.30-12.30 – Spring Tax Update – Rebecca Benneyworth

Watch out for our new AML, Ethics and GDPR E-Learning Programmes – available from February 2024.

“Excellent delivery, easily understood with some good points raised.” Delegate, Autumn series

FAQs from recent courses

Financial Reporting

A manufacturing company incurs costs of ‘trial runs’ prior to commissioning some new machinery. Is this capital or operating expenditure?

This is likely to be capital expenditure. Paragraph 17.10b of FRS 102 states that an entity should capitalise ‘any costs directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management’ and it makes specific reference here to ‘ testing of functionality’. A key consideration is whether the trial runs are crucial to implementation of the machinery.

Audit

In terms of ISQM 1 implementation, do we need to request updated quality statements every year from service providers?

ISQM 1 has required firms to seek supplier quality statements from service providers who are providing ‘human, technological or intellectual resources’ for use in the firm’s system of quality management. Annual updates are not formally required, though firms may consider requesting updates where the providers’ services change substantially year on year.

Practice Regulation

What’s your view on the need for non ICAEW members in ICAEW firms to comply with the new ICAEW CPD requirements?

The new CPD rules specify that firms will have a responsibility to ensure that ICAEW members and other ‘relevant persons’ are compliant with the new regime. A relevant person includes reciprocal members and ‘regulated individuals’, non ICAEW members but who are ‘authorised or licensed by ICAEW’ to perform certain regulated functions.

The implication here is that members of other professional bodies who are not regulated individuals would not be covered by the new ICAEW rules. However, many firms we have spoken to are taking the approach that all colleagues must complete the same amount of CPD – whether that be sufficient to meet the ICAEW regulations or that of another body (i.e. ACCA or CIOT) – whichever is the higher.

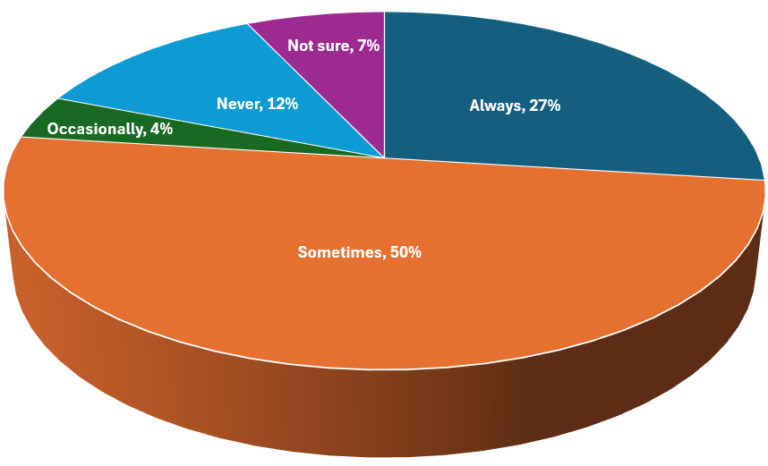

In a recent poll

Do you feel that your audit team meetings meet the new requirements of ISA (UK) 240 revised?

This poll question has been raised on audit courses. Auditors must now ensure that internal ‘kick off meetings’ include a ‘discussion’ about fraud risk. Although the responses indicate considerable awareness of this requirement, sometimes evidence of such a discussion isn’t always evident on the file.