Upcoming courses

Our 2024 CPD programme is now live and open for bookings. Click to download our brochure and booking form.

Date – Time – Course – Presenter

2nd July – 9.30-11.00 – Academies – The Fundamentals – James Charlton

2nd July – 11.15-12.45 – Academies Update – James Charlton

27th Sept – 9.30-12.30 – Introduction to Audit part 1 – James Charlton

1st Oct – 9.30-12.30 – Practice Assurance Update – John Selwood

2nd Oct – 9.30-11.30 IFRS Comprehensive Refresher – Clare Jones

2nd Oct – 11.45-12.45 – IFRS Update – Clare Jones

3rd Oct – 9.30-11.30 – How to Close Down an Audit – Richard Hemmings

8th Oct – 9.30-12.30 – Introduction to Audit part 2 – James Charlton

10th Oct – 9.30-12.30 – Autumn Tax Update – Rebecca Benneyworth

14th Oct – 9.30-12.30 – Autumn Financial Reporting Update – John Selwood

16th Oct – 9.30-11.30 – Ethics for Accountants and Auditors – Peter Herbert

Our new AML, Ethics and GDPR E-Learning Programmes are available now.

“Excellent delivery, easily understood with some good points raised.” Delegate, Autumn series

FAQs from recent courses

Financial Reporting

Does a change in depreciation rate in the year need to be disclosed in section 1A accounts?

Paragraph 1AC.3 of FRS 12 requires disclosure of ‘the accounting policies adopted by the small entity in determining the amounts to be included in respect of items shown in the statement of financial position and in determining the profit or loss of the small entity.’ We would expect to see information here on depreciation rates. If the change in rate materially affected the charge, the comparative rate should also be disclosed, though there would be no specific requirement to quantify the impact of the change.

Audit

Why does testing controls over journals help at all if management can override the controls?

ISA (UK) 315 paragraph 26 does not require controls over journals to be tested but requires design and implementation work to be carried out where relevant to a risk of misstatement at the assertion level. There is a difference! If the auditor’s design and implementation work reveals that even the most basic controls over journals are missing, our expectation would be that the risk grading would increase in this area and more in-depth substantive testing would be performed as a result.

AML

If an individual moves, do we need to obtain replacement non photo ID as proof of address?

There is no specific requirement to get replacement ID when someone moves, though you may consider it appropriate, following a risk-based approach. Evidence suggests that professional bodies are in favour of firms getting evidence of change of client address.

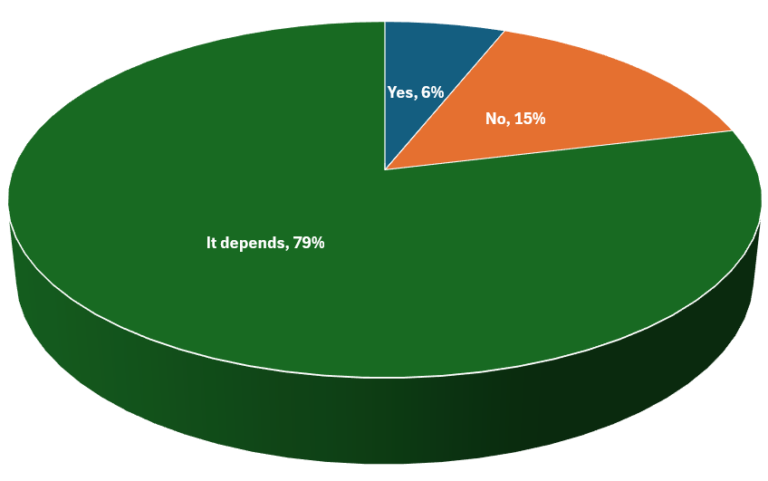

In a recent poll

When testing trade creditors substantively, should the total creditor balance be used as the starting point for the sample size calculation?

This poll was used during a recent audit update and is a question which often crops up. Principles of directional testing often lead us to test credits for understatement, so if we’re testing credits for what’s not there, why use what is there as the start point for the calculation? Even if a sample size calculator is used in this area, important considerations will be to test key suppliers based on purchase ledger activity rather than being too focused on the year-end balance; and to perform a robust review of post year end transactions for missed accruals.